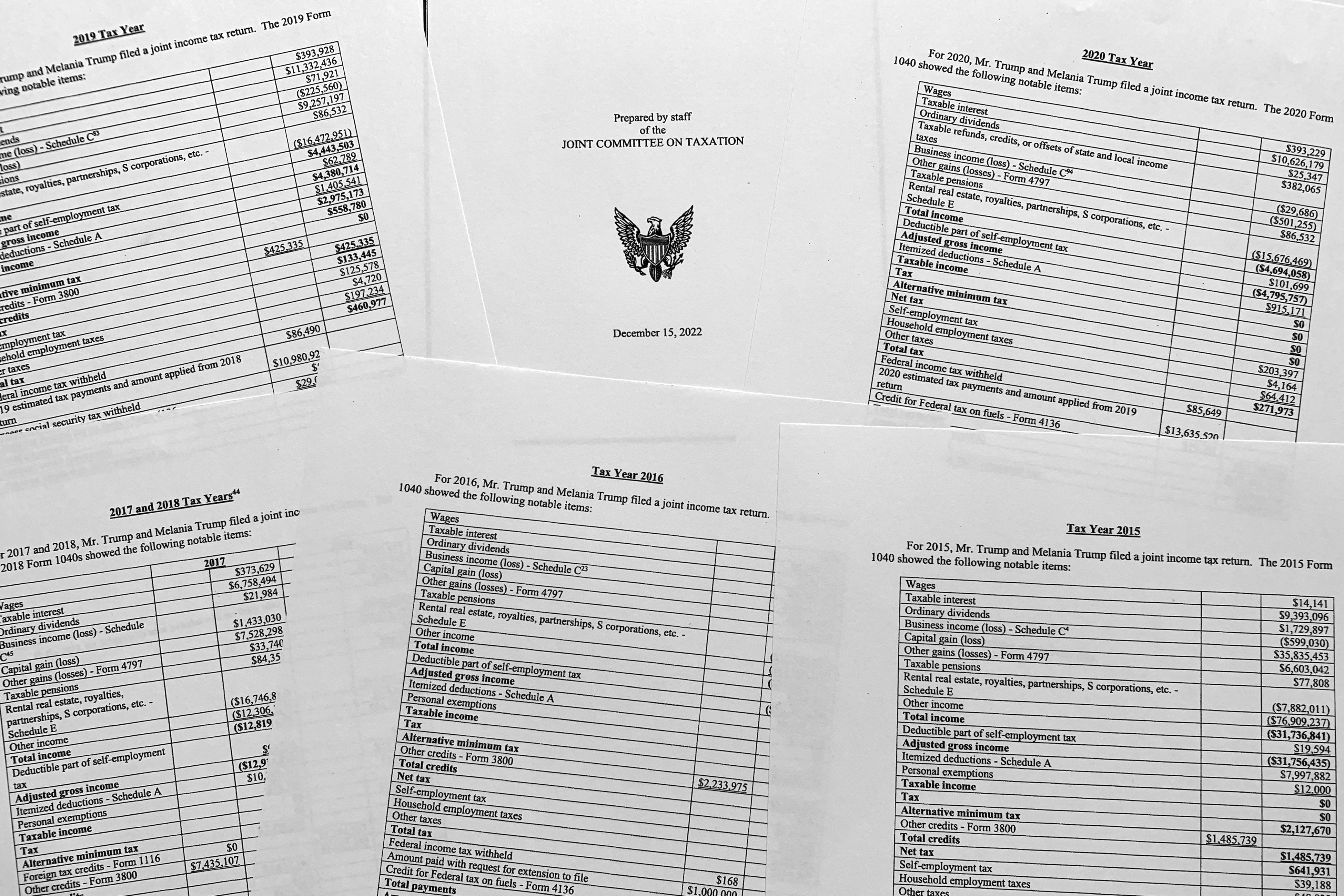

“As a long term business person I was amazed how you could report $100,000,000 in income and have a tax under $1000” said House and Ways Committee Member Don Beyer (D) of VA said in an interview with Mika of MSNBC Morning Joe.

The answer: Claim $300,000,000 in unsubstantiated deductions. The tricks used by people like Trump is to change the estimated values of select properties. It’s all on paper, so they can make and keep $100 MILLION in income because they claimed a loss in property value – but it is a fake loss!!

As a long term business person I was amazed how you could report $100,000,000 in income and have a tax under $1000

Don Beyer (D) VA

Why Was the Mandatory IRS Audit Not Done

Next, in another interview on MSNBC Morning Joe discussed IRS issues and Treasury Dept investigation with Congressman Tom Suozzi (D) New York. “Was it by favor or because the system was broken down?” They will investigate and Tom wants to approach it without politics. Congress wants legislation in place that forces the President to comply with the law. There is no retribution otherwise, especially if the president appoints the Treasury Secretary who oversees the IRS.

Charities and Deductions

Trump claimed ‘cash contributions’ to charities on tax returns. There are many issues to investigate. Including the fact that there was only 1 inexperienced agent reviewing Trumps tax returns. No expert on partnerships or any other complex business arrangement use by Trumps tax lawyers. IRS failed to properly assign agents knowledgeable with expertise in complex accounting.

Washington Post Editorial Board: Tax Records Reveal Scandals

Nevertheless, Washington Post opinion (by the Editorial Board) concludes Trumps tax return REVEALS ‘many scandals’. Trumps pay almost no taxes – less than a teacher in America. That should arouse anger – but it does not arouse anything for half of America; still the Trump crime family may actually go down on this one.

Is The Republican Party Americas Greatest Enabler of White Collar Crime

Many rich Americans (like Mark Cuban) pay their taxes. But many do not pay. The Republican party may be the greatest enabler of White-Collar Crime. The Republicans have defunded the IRS, who are our “Financial Police”. The Republicans have defunded our most important police because they make America money through enforcement and oversight, but for Trump it is a lawless world. Republicans have stunted the IRS enforcement capabilities. So, why does it seek to defund the IRS? Now we can see why. Now we get to see how that actually plays out. The rich can now outspend the IRS. The IRS is unable to hire enough agents and enough accounting specialists capable of understanding and auditing the complex returns and dealing with lawyers of the rich. And thus, the rich white-collar criminals of America just continue to get away with bullshit deductions year after year.

The rich outspend the IRS! The IRS cannot employ enough agents to deal with lawyers employed by the rich to fight (using their time consuming delay tactic of explain, explain, explain) their audits.

Republican policies and tactics put the tax burden completely on average Americans .. it ALL falls on them. Or at least a lot more. Voting Republican puts more of the Federal and State budgets on the shoulders of Average Americans. That’s just a fact backed up by any given voting record.